Niftybias

Niftybias is a new concept which could bring a welcome change about the perception of the stock market. Hitherto stock market is considered unfriendly to small investors. It is also not wrong in considering the stock market to be so. It could be so because of government policies and perception of the small investor about the market. Government tried and trying to rope in small investors into the market through mutual fund route.

People say should invest for long term. Is it correct?

Not always. There is no point in investing at the top. It is where Niftybias is handy. It gives you an elegant way of handling the stock market.

Niftybias determines pattern of the movement of the nifty (both future/spot).The pattern of the Niftybias could be useful for selling and buying. This alternate bout of selling and buying is quite natural phenomena which will repeat itself.

Dear readers how Niftybias help small investors?

Niftybias will have a positively biased period to sell and a negatively biased period to buy. When Niftybias is positively biased stock valuation will be high and small investor can merrily sell. When Niftybias is negatively biased stock valuation will be low and small investors can again merrily buy .For more technical details about Niftybias follow www.sagacontratrading.com

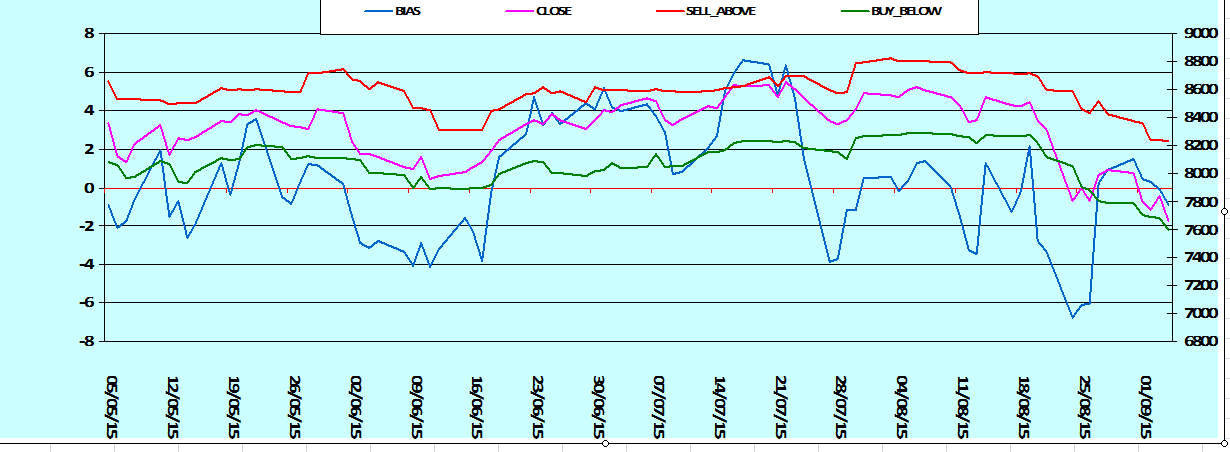

NIFTYBIAS-BLUE LINE

MORE ABOUT NIFTYBIAS

NIFTYBIAS greatly relieves anxiety of small investors because it correctly indicates the instance of making decisions. Investors have to merely follow the indications of the Niftybias. Niftybias reflects the mood of the market. It reflects the subsequent market trend.

NIFTYBIAS and NIFTY could move in tandem with each other or move in a divergent fashion. Trend reversal takes place when Niftybias and Nifty moves in a divergent fashion. SEE Niftybias-Blue line and Nifty future Pink line making divergent moves although in small manner. Though Nifty future goes down Niftybias trends up indicating market will go up next day. Normally it occurs so.

Let’s see how nifty is biased in our point of view. Look at Niftybias (blueline) from the chart it is the only characteristic that moves above and below zeroline (Straight Red line). Don’t be confused with other lines. They could never cross zeroline (Could Nifty ever become zero – No never) those things will be explained with video.

So what is up to small investors? They should buy good quality stocks when Niftybias is negatively biased i.e. it is short period (maximum 40 days say). In this period Niftybias will be below zeroline (REDLINE)

Similarly when Niftybias is positively biased small investors (Minimum 1 Day to maximum 40 days ) shall book profit. In this period Niftybias will above zeroline (REDLINE).

So there is definitely a period during which nifty will rise and fall for period or vice versa. So every investor

Will have their own day. There are many things to learn and earn. For more technical details about Niftybias follow www.sagacontratrading.com